In 2016, a friend of a friend contacted me asking if I could help her buy a house. She was renting a 2 bedroom apartment in Seattle, at the time paying $1700 / month in rent.

After working at Boeing for 6 years, living below her means, Stephanie was able to save up about $12,500 / year with a total of $75,000 to put down.

When we met and talked about her plans, goals, and lifestyle, we determined that the BRRRR Ownership Strategy was the best approach for Stephanie. She did not want to get overly involved in House Hacking, but she does see the long term value of owning real estate assets.

Financing

She was approved for up to $750,000 to purchase a home with 10% down payment at 3.6% interest rate. However, if she bought at this price, she would empty her bank account and her mortgage payment would be about $3,068 / month. As always, our goals is to keep monthly housing liability roughly the same as when renting, so we started shopping at $350,000 so her payment would be about $1410/mo and not empty her savings. I'd like to point out:

When you are approved for $750,000, it can be very difficult to purchase a property at $350k.

Obviously, the higher price homes are much nicer, bigger, in better areas, are better for entertaining, and generally are more fun to live in.

HOWEVER, we have a long term plan. We were looking for a deal that met at least 2 of the 3 Equity Growth criteria. We were patient, and we found it!

Making Offers

Stephanie made a low ball offer on a Lynnwood Split Level that was dated and had deferred maintenance. The 4 bedroom, 2 bath property was listed for $350,000, we offered $300k, they countered at $330k, and we finally got into mutual at $312,500. The sellers were getting divorced and motivated to sell the property. On top of that, the house is located in a growing part of Lynnwood, on the border of Mukilteo.

Inspection and due diligence went very smooth and we moved to close.

The Work & Costs

Before moving in, Stephanie had popcorn ceilings scraped, bathroom tile replaced, paint, and new flooring installed on the top floor. Later on while living there, she had the windows replaced and exterior painted. She personally spent time and energy caring and manicuring the landscaping to create an oasis in the suburban setting.

All of these repairs cost about ~$50,000. She did $30,000 initially and $10,000 per year for the next 2 years. All the while, Stephanie was paying slightly less than she was paying in rent.

The Result

Fast forward to 2020, Stephanie is engaged! She contacted me to discuss renting out her house as she plans to move in with her finance.

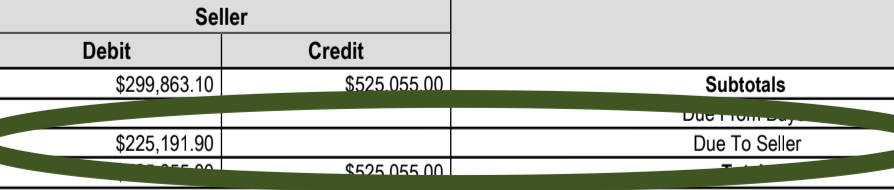

After analysis, we determined the property could sell for about $545,000. From this sale, Stephanie will recover her original $80,000 investment ($30k down payment + $50k repairs) and realize about $145,000 profit.

Stephanie will put the $80,000 back in her bank account and re-invest the $145,000 into a non-owner occupied rental property.

Actual snippet from Stephanie's Final Settlement Statement

What's Next for Stephanie??

Our plan going forward is to purchase small multi-family property that meets at least 2 of the 3 equity growth traits in effort to double her profit (again) in 4 years.

Stephanie utilized BRRRR Ownership, was patient on finding a deal with equity growth potential, executed her plan over time, and now she has recovered all her earned income and has an active real estate acquisition plan in place.

Anyone can do this, EVEN YOU!